The tightened belt is still in fashion but it’s a style that is transparently thin says Geoff Tily.

For years the logic of austerity has governed UK economic policy. In his March 2018 Spring Statement, the Chancellor, Philip Hammond, finally celebrated a “balanced budget”. But rather than vindicating the logic of austerity, his claims expose austerity as an emperor with no clothes.

The Chancellor has not been given an easy rise by commentators and economists, but the false logic of austerity continues to diminish any criticism. The most prominent critics in the Institute for Fiscal Studies (IFS) savage the government for the poor performance of the economy and hardships to come, but their ire is focused on what they see as phoney promises of politicians of all parties. Even the radical Modern Monetary Theorists (MMTs) simply want to throw away the rulebook of the austerity empire.

The Chancellor has not been given an easy rise by commentators and economists, but the false logic of austerity continues to diminish any criticism.

In the meantime, the failure of policy is not fully articulated. The crisis of wages and the quality of work is recognised but explained as a failure of productivity – meaning supply – rather than policy – demand. The failure is no less remarkable on its own terms. Achieving a balanced budget has:

- taken twice as long as expected, at £320bn (or 1.7 times) more than the expected cost;

- damaged not strengthened economic growth, with GDP growth greatly reduced alongside the real wage crisis; and

- not repaired the public debt, which is now around £500bn higher than it was expected to be in the planned peak year and is far closer to perceived danger levels than before the emperor seized power.

And much of central and local government is in crisis.

The fact that austerity can and must be undone becomes clear when we:

- examine the original logic of austerity and set it against the rival, Keynes view;

- trace the failure of the policy through the economy and the public finances; and

- examine how and why different economic perspectives fail to uncover fully this failure.

Two rival theories

The macroeconomic case against austerity logic is simple and widely supported. When the economy is not in rude health, spending cuts undermine economic growth and, via lower tax revenues and higher welfare expenditure, hurt the public sector finances. Under the same conditions, spending increases will do the reverse – strengthen the economy and the finances. This is simple Keynes.[i] The theory is supported by evidence from UK history, with episodes of austerity coinciding with deteriorations in the public debt ratio and vice-versa. [ii]

In the austerity empire this logic is reversed, as this extract from Budget 2010 illustrates:

“The most urgent task facing this country is to implement an accelerated plan to reduce the deficit. Reducing the deficit is a necessary precondition for sustained economic growth. To continue with the existing fiscal plans would put the recovery at risk, given the scale of the challenge. High levels of debt also put an unfair burden on future generations.”

The macroeconomic case against austerity logic is simple and widely supported.

The Treasury logic runs from improved public finances to a stronger economy, so that reduced deficits lead to higher growth and lower debt. This doctrine was motivated in part by celebrated (though later discovered to be flawed) [iii] empirical results from academia,[iv] which were deployed by George Osborne in a February 2010 lecture setting out his vision:[v] “The latest research suggests that once debt reaches more than about 90% of GDP the risks of a large negative impact on long term growth become highly significant.”

Figure 2:

Figure 3:

Empire economy

Perhaps aware of what happened in these earlier episodes of austerity, today’s emperors have proceeded with caution. From a position in the global financial empire after his spell as George Osborne’s closest economic advisor, Rupert Harrison remarked: “The rhetoric of the cuts was always worse than the reality in order to gain public support”.[vi]

Cuts were made only to the growth of spending rather than to spending in total. The result was to reduce economic growth, not drive the economy into recession. Nonetheless the overall impact was still far greater than expected and corresponded very closely to simple Keynesian arithmetic. With government expenditure contributions reduced by 1.3 percentage points (ppts) a year relative to the six years ahead of the crisis, a multiplier of 1.5 would predict nominal growth down by 1.9 ppts a year. Over the first parliament for which the logic of austerity ruled, GDP growth was down 1.8 ppts a year (Tily, 2018). [vii]

The same, and in many cases much larger, effects are seen across the globe. The only countries that have avoided this fate have not embraced the austerity logic, though Germany for example has chosen to keep this fact to itself, even while encouraging other countries down the path of the austerity doctrine (ibid.).

The attitude to the multiplier – that measures the impact on the economy of a change in government spending – exemplifies how the empire is closed to the logic of rival arguments. The Office of Budgetary Responsibility multipliers were originally based in part on those of the International Monetary Fund (IMF); when the IMF recognised in 2012 that the experience of austerity across the world indicated multipliers, at between 0.9 and 1.7, were much larger than they had previously thought – about 0.5, [viii] the OBR made no reassessment. I am also unaware of any substantive review of the position from within academia.

In total, real wages will have fallen by around 4% in the decade to 2018. The norm since the 1930s has been an increase of around 25% a decade.

Empire jobs and productivity

Weak growth in the economy forced an adjustment to incomes for the household and corporate sectors. Both labour income and profit growth slowed, though households took a disproportionately bigger hit. Within the labour market, the adjustment has been on price rather than quantity: jobs growth has held up, but the quality and reward for work have deteriorated. Annual wage growth fell to 1.9% after the crisis compared to 4.2% ahead of the crisis while annual employment growth rose to 1.2% after the financial crisis compared to 0.9% before the crisis.

In total, real wages will have fallen by around 4% in the decade to 2018. The norm since the 1930s has been an increase of around 25% a decade. The only decades remotely comparable in modern history are those through the First World War and into the disastrous 1920s.

The Trades Union Congress definition of insecure work combines 1.9 million in employment but on zero-hours contracts, agency workers and casual workers and the 1.9 million in self-employment who are paid less than the minimum wage. Significantly, insecure work disproportionately affects young workers, Black, Asian and minority ethnic workers and women. Workers endure harsh and demeaning conditions, with normal benefits like sick pay and holiday pay the exception rather than the rule.

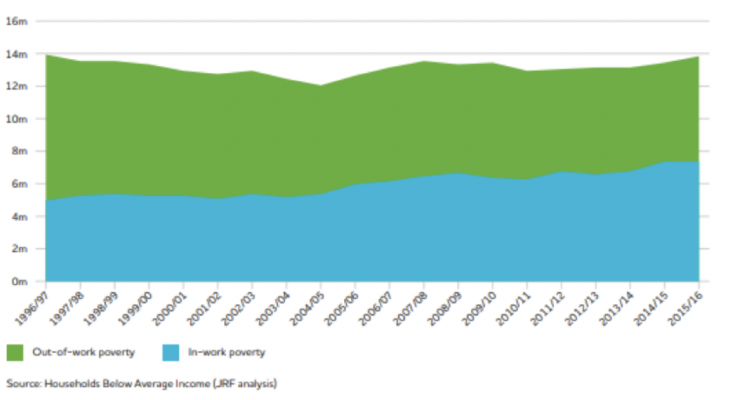

More generally there is now a crisis of in-work poverty. Joseph Rowntree Foundation figures show the total of 14 million people living in poverty in the UK – over one in five of the population – has changed little over the past 20 years. Instead there has been a switch: out-of-work poverty has been reduced by two million, while in-work poverty has increased by two million (see figure 1).[ix]

The preoccupation with productivity also follows the backward logic of the empire. But since the financial crisis, low productivity outcomes are the consequence of the labour market adjusting to demand-driven, weak growth through price rather than quantity. Weak output growth is compared with disproportionately higher jobs growth, and productivity is disproportionately lower. But it is low as a result of the wages adjustment; it is not the cause (see Tily, 2016 for a fuller account)[x].

Plainly there is much wrong on the supply side of the economy, including

- a financial system that fosters speculative excess rather than productive advance

- an absence of industrial planning,

- limited regional and sectoral policies, and

- inadequate support for upskilling and attacks on trade unions.

But these defects long pre-date the global financial crisis and austerity. They do not explain what changed after 2008.

Balance was expected five years from the start of the introduction of austerity just after the end of financial year 2009-10; it is now expected to take ten years.

Empire public finances

In May 2010 George Osborne inherited recovering growth and improving public sector finances, easily shown as driven by repaired government revenues rather than reduced spending – by Keynes not austerity logic. The planned continued improvement under austerity then fell far short.

The Spring Statement this year at least provided an opportunity for a more considered view of the empire public finances in the round, based on the latest assessment by the Office for Budget Responsibility (OBR).

Critical to policy has been the use of “fiscal targets”: one for the “deficit” that measures how far revenues fall short of spending – cyclically adjusted current budget (CACB) – and one for debt, the cumulative shortfall over time – public sector net debt – both as a share of GDP. The Chancellor used the Spring Statement to celebrate “balancing the books” on the former measure.[xi]

According to the OBR’s original forecast in June 2010, the deficit measure would be in surplus in 2014-15 although the target permitted one year’s slippage to 2015-16. On the OBR’s latest forecast, the cyclically-adjusted surplus is delayed to 2019-20. Balance was expected five years from the start of the introduction of austerity just after the end of financial year 2009-10; it is now expected to take ten years (see figure 2).

On the broadest measure of the deficit in cash terms: over 2010-11 to 2014-15 cumulative public sector net borrowing was expected to be £450bn; borrowing over 2010-11 to 2019-20 is now expected to be £770bn. That’s nearly three quarters more than expected.

But Philip Hammond abandoned the CACB target in January 2017. Instead he opted for a measure including capital spending, targeting a reduction of “cyclically adjusted net borrowing” to below 2% of GDP in 2020-21. He abandoned the first target not only because it hadn’t been met, but also because it did not work. Leaving aside specific target dates, CACB has been broadly in balance since 2016-17 (see figure 2). But – and this is fundamental to the case against the austerity emperor – the perceived gains in terms of economic growth and therefore debt reduction have not materialised.

Under the original plans, public debt was expected to peak at 70.3 % of GDP in 2013-14. It is now thought to have peaked in financial year 2017-18 that has just come to an end (figure 3). So, three years became eight. The peak is now expected to be 85.6 % of GDP, not far short of the discredited 90% figure that the whole of policy was set to avoid.

Once more: the austerity emperor has no clothes.

If spending was expanded in a decisive and material way, economic activity would be strengthened, and it would turn out that we could have afforded decent public services and decent wages and conditions for public sector workers all along.

Cuts evermore

But until we acknowledge that the emperor is naked, the same course is remorselessly imposed. The OBR show cuts to departmental spending continue through to 2022-23: according to their “real resource departmental expenditure limit spending per capita” measure,[xii] the end of austerity is not even on the horizon.

And moreover, even with these cuts, as figure 3 shows, only the slightest impression will be made on the public debt. The forecast 77.9 % of GDP in 2022-23 is still significantly above the original planned peak. On the standardised European measure, almost no improvement is evident. In cash terms, in the original peak year (2013-14) debt was expected to be £1,240bn. In 2017-18 it will be more than a half a trillion pounds higher at £1,780bn.

Various other items have moved in and out of the statisticians’ definition of public debt. Since 2010 the most striking items have been the inclusion of around £175bn of subsidies to the banking sector under the “term funding scheme” and “funding for lending” – massive increases to public debt which caused nobody to bat an eyelid. Very crudely, and ignoring all other changes, adding this subsidy to the £320bn extra borrowing takes us to the £ 0.5 trillion extra debt.

The austerity empire

Plenty of commentators and economists have been throwing rotten fruit at the emperor. But much commentary does not capture the matter-of-fact of the failure, and even encourages the emperor to take a harder line.

In the vanguard is the Institute for Fiscal Studies (IFS). It contests the Chancellor’s claim that there is light at end of the tunnel and emphasises hardship ahead. But there is hubris in IFS director Paul Johnson’s lambasting “the spin and bluster of politicians on all sides pretending there are easy solutions, that the promised land is just around the corner, or that they can reinvent the laws of economics. There aren’t. It isn’t. And they can’t”.[xiii] On this view we will be trapped forever in the austerity empire: “The deficit is dead, long live the debt,” as the Resolution Foundation put it.[xiv] The main solution offered is that future spending cuts can only be avoided with higher taxes – given no major favourable turn in economic conditions. This logic dominates the media and the BBC in particular.

Others rage harder against the government’s approach. Chris Dillow on the “Stumbling and Mumbling” blog saw the message of the Spring Statement as “stupidity lives”.[xv] In exasperation he restated the household fallacy:

“Government finances are not like household finances, simply because public spending is so big that it affects the rest of the economy – something which is not true of households. This, of course, should be known by any first-year student.”

Simon-Wren Lewis is justly fatigued by his campaign against austerity. Ahead of the Spring Statement he repeated the case for “deficit spending” and rejected empire policies as the wrong approach.[xvi] “We have just been through a period where politicians have pretended the deficit was all important, and this pretence has inflicted great harm”.[xvii]

Immediately after this statement, however, he cautioned against going as far as the anarchists of the austerity empire – the “MMTers”: “But that does not make the opposite point of view – that the deficit never matters – right”. Along with those who champion “peoples’ quantitative easing (QE)”, “green QE” and so on, MMTers want to finance a major increase in spending through a deliberately aimed expansion of the central bank balance sheet.

But this seems to be two wrongs that could make a right.

The idea of deficit spending or ramping up the public debt still conforms to the logic of the austerity empire. With higher borrowing as an explicit goal of these versions of policy, both approaches are inherently unable to identify the present failure of policy in terms of too much borrowing and debt. On a political level they propose a course of action that is wrongly, and therefore needlessly, at odds with public sensibilities around excessive debt.

On a Keynes view, the idea of deficit spending is a misnomer. Normally we should talk about loan-financed expenditure. Deficit spending confuses an outcome of policy (public sector net borrowing) with the means to its financing (a loan). [xviii]

Now there are countless other vital questions about the best way of financing expenditure and how monetary policy should support fiscal policy in the short term, and on wider relations between monetary policy and private activity and between the state and the market. For the present, it is imperative to note that QE has in practical effect operated to support a failed fiscal policy, and not as part of a successful fiscal strategy. Under the QE scheme the Bank of England holds £435bn or nearly 25% of UK government bonds. Unsurprisingly there is alarm at this colossal scale of monetary support, but the apparent, and thankfully receding, goal of tightening monetary policy is hardly a strategy to improve matters. Unfortunately, the Bank of England’s repeatedly thwarted expectation of inflation as a result of a shortfall in supply conforms entirely to the logic of empire thinking.

So after a double dose of austerity has damaged, not strengthened, the economy and therefore made the public debt worse, a third dose of austerity is now underway. And it is not even expected to make much impression on the public debt.

Lord Kerslake – once boss of the civil service – is one of the few public figures who has called it as it is: an “extraordinary failure” of policy.[xix] Paul Johnson’s “laws of economics” only exist in the austerity empire, they are not relevant to the real world.

The austerity emperor has inadvertently proven the Keynes causality in the negative. It is now time to operate it positively. Loan-financed public expenditure will strengthen the economy and therefore strengthen the public finances.

The empire must fall

The perceived constraints on public spending that dominate the media are non-existent under current economic conditions. If spending was expanded in a decisive and material way, economic activity would be strengthened, and it would turn out that we could have afforded decent public services and decent wages and conditions for public sector workers all along.

The logic of the empire also distorts the past. Contrary to conventional wisdom, in the great depression the government began vigorously to expand spending from 1934. “We have now finished the story of Bleak House and that we are sitting down this afternoon to enjoy the first chapter of Great Expectations”, Chancellor Neville Chamberlain proclaimed in his Budget speech. Over the five years from the trough of the crisis in 1929, real government consumption expanded by around 4% a year and GDP grew by 4% a year. Contrast with the present, when over the five years from the trough in 2009 spending expanded by around only 1% a year and GDP grew by only 2% a year. And these illustrative numbers from the Bank of England historic data resource are generous to present outcomes.

We should take a real lesson from the revival of interest in Clement Attlee. The first majority Labour government in British history inherited post-war debt of 250% of GDP, yet created the NHS, provided education for all, built “homes for heroes”, strengthened the welfare state and nationalised several industries. While it did this the economy began to grow with unprecedented vigour, the deficit moved into surplus and the public debt fell. No fiscal targets were necessary, because the naked emperor had been identified and deposed.

References:

[ii] Victoria Chick, Ann Pettifor and Geoff Tily (2010 [updated 2016]) ‘The economic consequences of Mr Osborne’, Prime economics. http://static1.squarespace.com/static/541ff5f5e4b02b7c37f31ed6/t/56ec3ccaa3360c829bb2a001/1458322639033/The+Economic+Consequences+of+Mr+Osborne+2016+final+v2.pdf

[iii] Thomas Herndon, Michael Ash and Robert Pollin (2014) ‘Does high public debt consistently stifle economic growth? A critique of Reinhart and Rogoff’, Cambridge Journal of Economics, Volume 38, Issue 2, pp. 257-279.

[iv] Carmen M. Reinhart and, Kenneth S. Rogoff (2010) ‘Growth in a Time of Debt’, American Economic Review, 100 (2): 573–78. doi:10.1257/aer.100.2.573.

[v] George Osborne, ‘A New Economic Model’, Mais Lecture, 24 February 2010.

[vi] ‘Theresa May’s censure proved unlucky for Osborne’, Financial Times, 14 July 2016.

[vii] Geoff Tily (2018), ‘Reversing Austerity’, in Andrew Harrop (Ed.), Raising the bar: how household incomes can grow the way they used to’, Fabian Society.

[viii] Olivier Blanchard and Daniel Leigh (2013) ‘Growth Forecast Errors and Fiscal Multipliers’, IMF Working Paper, January.

[ix] Joseph Rowntree Foundation, UK Poverty, 2017. file:///C:/Users/TilyG/Downloads/uk_poverty_2017updated%20(1).pdf

[x] Geoff Tily (2016), ‘The productivity fallacy’, Royal Economic Society Newsletter, July.

[xi] The celebration continued when on 25 April 2018 the ONS published the first outturn figures for 2017-18 showed the (not cyclically-adjusted) current budget move into surplus of £0.1bn when the OBR expected a deficit of £0.1bn. This most marginal improvement was in contrast to public sector net debt coming in at 86.3% of GDP, 0.7 percentage points (and £15bn) higher than OBR forecast.

[xii] Office for Budgetary Responsibility, Economic and fiscal outlook, March 2018; Chart 4.6.

[xiii] ‘UK will struggle to ease austerity in coming months, think-tanks warn’, Financial Times, 14 March 2018.

[xiv] Torsten Bell, blog, 12 March 2018. https://www.resolutionfoundation.org/media/blog/what-philip-hammond-will-say-tomorrow-the-deficit-is-dead-long-live-the-debt/

[xv] ‘The Persistence of Fiscal Stupidity’, 14 March 2018, http://stumblingandmumbling.typepad.com/stumbling_and_mumbling/2018/03/the-persistence-of-fiscal-stupidity.html

[xvi] https://mainlymacro.blogspot.co.uk/2018/03/budget-deficits-fiscal-councils-and.html

[xvii] The IMF are taking tentative steps in this direction, for example recently asking the question “do declines in nominal interest rates following the global financial crisis mean that governments can safely borrow more?” and answering: “yes, but probably only by a few percentage points”; Philip Barrett (2018) ‘Interest-Growth Differentials and Debt Limits in Advanced Economies’, IMF Working Paper, April 6. [xviii] In national-accounts terminology, it confuses the balancing item on the income and capital account with an entry on the liability side of the financial account. See also Geoff Tily, ‘Fiscal Fallacies’, (1) & (2), Touchstone blog, 9 and 10 November 2015, http://touchstoneblog.org.uk/2015/11/fiscal-fallacies-1-keynes-wanted-government-loan-expenditures-not-deficit-spending/ & http://touchstoneblog.org.uk/2015/11/fiscal-fallacies-2-accounting-identities-and-the-case-for-government-loan-expenditures/

[xix] Geoff Tily, ‘Kerslake review of Treasury warns that austerity has failed’, Touchstone blog, 13 Feb 2017.

thank you, Geoff Tily.

The I am also of the same sentiment that austerity is a serious policy fiasco. The current finance and economic development minister for Zimbabwe on his maiden transitional stabilisation policy (TSP) explained kicked off his term with a mantra ‘Austerity to Prosperity’ and I have been trying to think the possibility of that prosperity taking noting that the economy actually moved from bad to a worse free fall since he started implementing austerity measures. The economy was also predicted to pass through bumpy drive but promised to prosper after a while I really cant see that happening